/10/ · Understanding how to choose Form 1095C codes for lines 1416 can be overwhelming Managing ACA compliance all year is challenging enough, but it's essential to select the appropriate codes for Forms 1095C If you enter incorrect codes, it could mean ACA penalties and more time spent fixing those errors · The IRS has announced a postrelease addition to the codes for the Form 1095C (see our Checkpoint article)According to an IRS website post, an applicable large employer that offers an individual coverage HRA (ICHRA) can use two previously reserved codes from Code Series 1 on Form 1095C, line 14, for reporting offers of coverage forWhere do I send it when I am done?

How Do We Report Ichra Coverage On Forms 1094 C And 1095 C

Aca 1095 c codes 2020

Aca 1095 c codes 2020- · Common 1095C Coverage Scenarios with Examples Completing 1095C forms can be confusing, but we're here to make it simple with this list of common 1095C coverage scenarios and examples As always, we are available to answer any questions you may have1095c codes 21 Get Form form1095ccom is not affiliated with IRS form1095ccom is not affiliated with IRS Home;

Irs Form 1095 C Codes Explained Integrity Data

Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1095C, steer clear of1095C and 1094C Generating with Avionté; · These codes were previously reserved from Code Series 1 on Form 1095C, line 14 To determine affordability, the employee's cost for the lowest cost selfonly silver coverage in the rating area in which they live minus the employer's ICHRA contribution must be no greater than 978% (for , 9% in 21) of the employee's earnings

ACA Codes Cheat Sheet JANUARY 19 PAGE 1 Form 1095C Code Series 1 and 2 For ACA 15 reporting going forward Code § 6056 and Code § 6055 have added two employerreporting requirements to the Internal Revenue Code (Code) Code § 6056 requires applicable large employers (ALEs) to provide an annualized statement at · The ZIP code used to determine coverage affordability will now be listed in line 17 of Form 1095C Also, at the beginning of Part II, along with listing a twodigit number for the plan year, employers must include the employee's age as of Jan 1, New due dates, reliefYearEnd Training ACA and 1095C's ;

· Pointers for Line 14 on the 1095C The bulk of the work in completing the 1095C will be with Lines 1416 in Part 2 Although the subject is too complex to cover fully in this article, keep in mind The "Offer of Coverage" on Line 14 — which involves nine codes — describes whether or not minimum essential coverage was offered to an · ACA reporting for the tax year will be different from years past because of the new Individual Coverage Health Reimbursement Arrangement (HRA) codes These new codes, in addition to the standard codes, must be populated on Form 1095C for fulltime employees and communicate critical information about their health coverage for the yearOur ACA experts break down all 1095 C codes and walk you through how to fill out lines 14, 15, 16, and 17 and Part III Avoid penalties from the IRS learn the differences between codes!

Updates To Form 1095 C For Filing In 21 Youtube

Common 1095 C Scenarios

Let's Look At The Most Common 1095C Coverage Scenarios · Plan Start Month All Applicable Large Employers (ALEs) must enter a twodigit code on Form 1095C Age and ZIP Code Inclusion Employees must submit their age as of Jan 1 and their ZIP Code must be included on the form Relief for Failure to Furnish The IRS won't impose a penalty on employers that fail to furnish Form 1095C to anyACA Companion Declination Export AQ;

Form 1095 A 1095 B 1095 C And Instructions

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

TOP Forms to Compete and Sign;When the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21ACA Companion Application – Individual and Mass 1095C Part II Overrides;

Aca Reporting Tips Introduction And Archive Usi Insurance Services

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Information See the Instructions for Part II of Form 1095C, later Also see Individual coverage HRA and Employee Required Contribution, later, for more information on how to calculate the amount reported on line 15 for offers of individual coverage HRAs Plan start month This is required for the Form 1095CThere are new 1095C codes in ACA Reporting for Failing to accurately populate your 1095C forms with the respective codes is one of the fastest ways of putting your organization at risk of receiving IRS penalty assessments The tax agency is currently issuing penalties for the 18 tax year and · For example, in , plan costs cannot exceed 978% of an employee's household income The new 1095C codes must be used by employers to show how they determined the affordability of their ICHRA plan According to SHRM, the revisions "may require employers to alter existing reporting systems"

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Form 1095 C Fauquier County Va

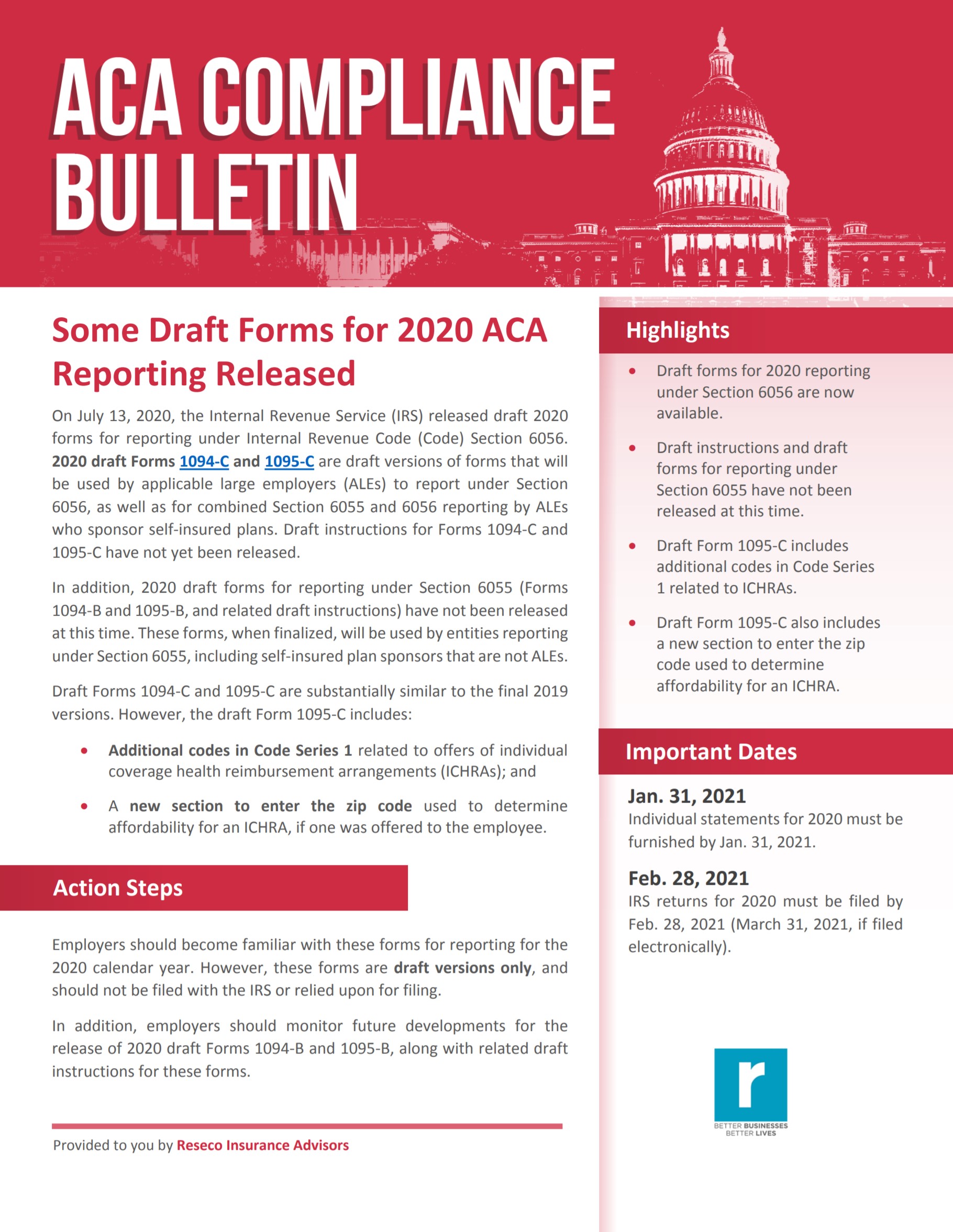

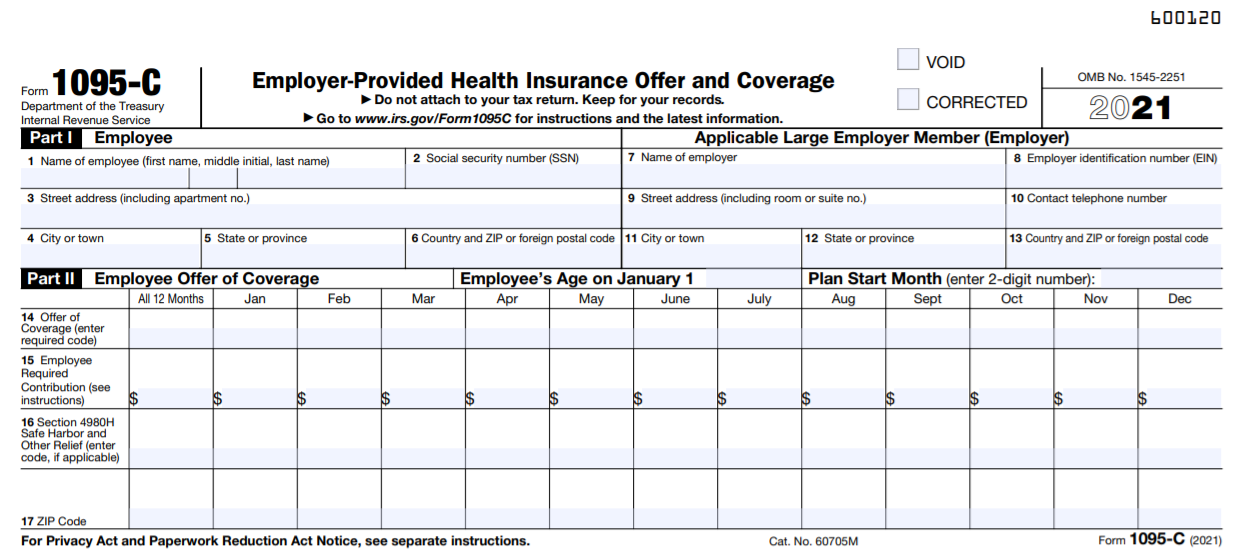

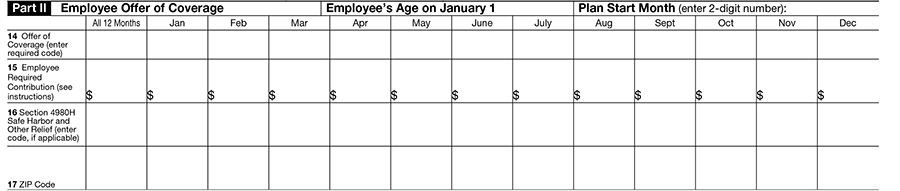

The Form 1095C is now required for reporting • Form 1095C includes additional codes in Code Series 1 related to ICHRAs Feb 28, 21 IRS returns for must be filed by Feb 28, 21 (March 31, 21, if filed March 2, 21 The deadline for furnishing individual statements for was extended to March 2, 21 Provided to you by · Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectivelyACA Companion – Individual and Mass

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Irs Announces Additional Ichra Codes For Form 1095 C

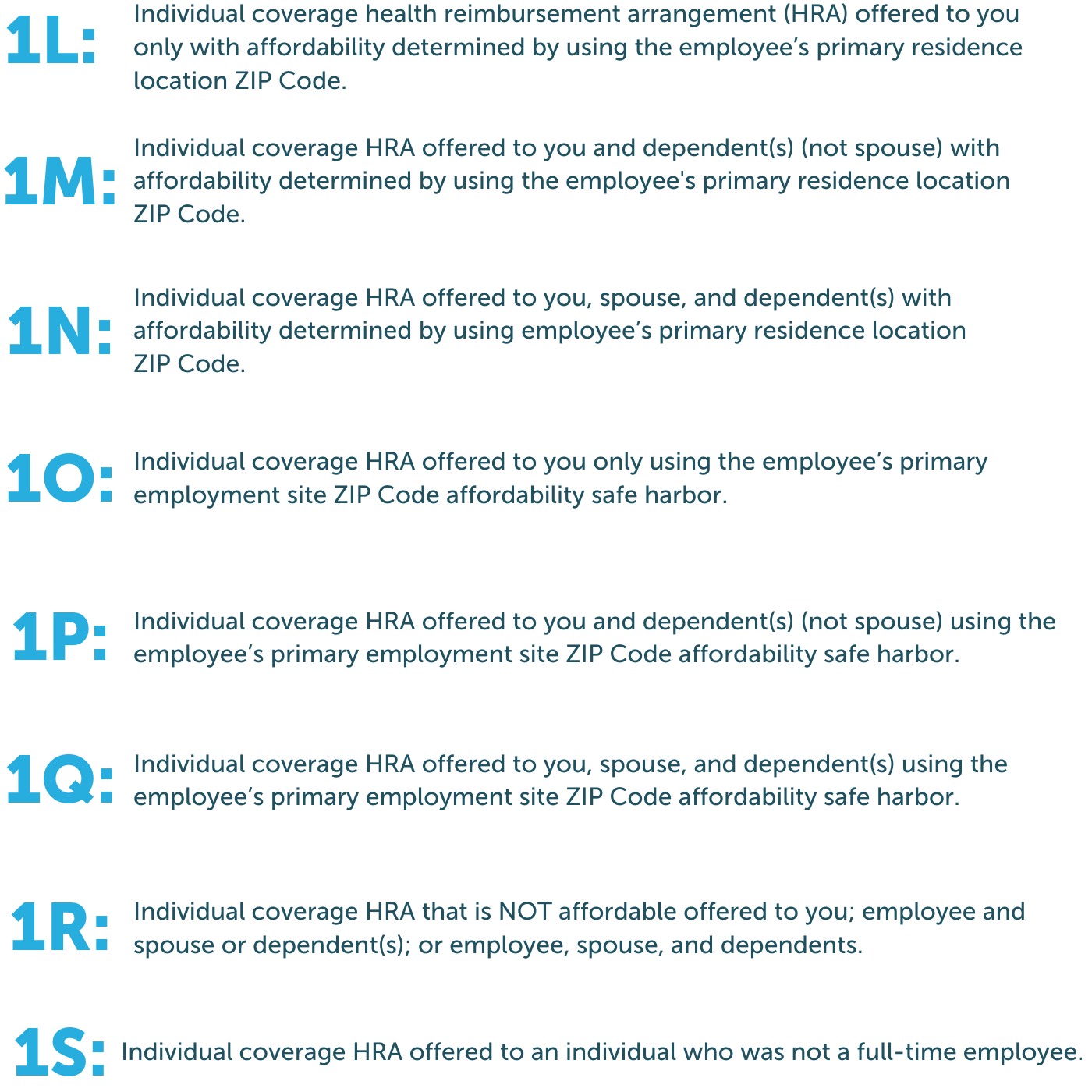

Form 1095C New ICHRA codes to enter on Line 14 From the tax year , employers need to report the Individual coverage health reimbursement arrangement (ICHRA) offered to employees and their dependents In addition to the existing codes, below are the new codes for line 141095 C Codes For can offer you many choices to save money thanks to 22 active results You can get the best discount of up to 60% off The new discount codes are constantly updated on Couponxoo The latest ones are on May 13, 21 11 new 1095 C Codes For results have been found in the last 90 days, which means that every 8, a new 1095 · Updated 1095C Employer Reporting Guide The IRS recently provided the final 1095C employer reporting forms and instructions The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last year Minor Changes to Form 1095C

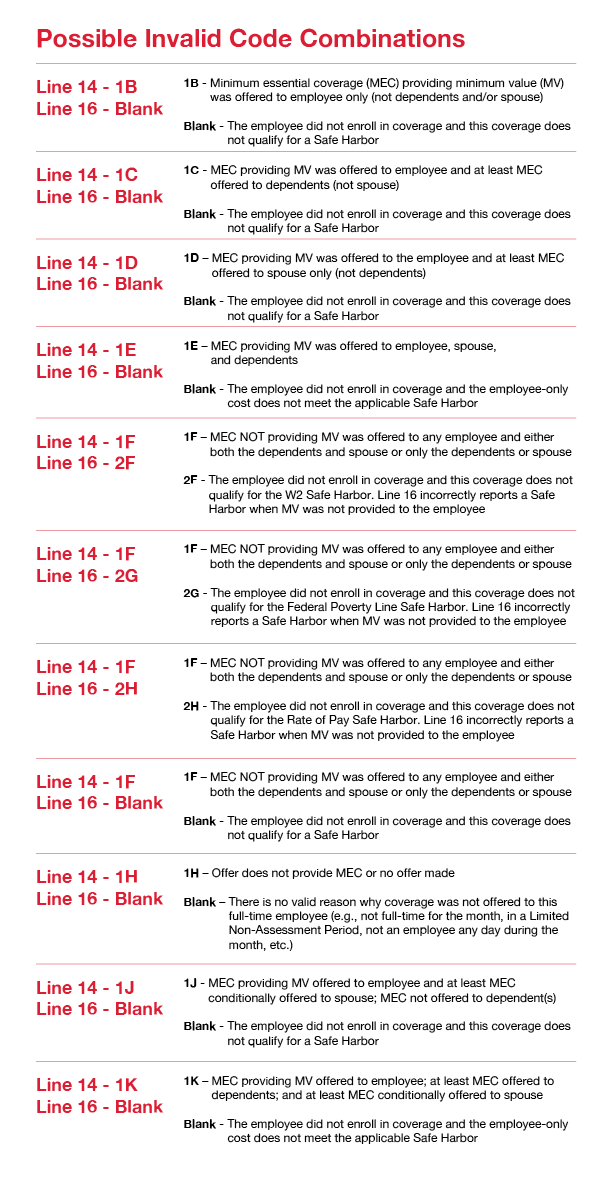

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

· Below, MP's HR services team provides a refresher on the important evergreen codes for ACA filing and a list of the new ones ACA Reporting Cheat Sheet Form 1095C Line 14 Codes Note that codes 1A, 1E, and 1H are the most commonly used 1A Qualifying Offer You offered a plan that was minimum essential coverage (MEC) and minimum value (MV) to the · The individual was not classified as a fulltime employee in any month in (ie, when the "all 12 months" column" of Line 14 on Form 1095C is Code 1G) · All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095B

Aca Reporting Solutions

Aca Code Cheatsheet

The 1095C forms are already filled out The employee does not need to complete any portion of the form The employee should provide the 1095C and 1095B (if applicable) to the tax preparer These03 Code Series 1 – Line 14 05 Code Series 2 – Line 16 06 Filling Out Form 1095C Page 2 Want to learn more about preparing and filing Forms 1094C and 1095C? · Part II of the Form 1095C now requires an employer to enter the employee's age as of the beginning of the calendar year ZIP Code The embedded Instructions for Recipient section in Form 1095C indicates that employers that offer ICHRAs to employees must disclose the employees' ZIP Codes if the employer uses the employee's location to determine affordability as

Code Series 1 For Form 1095 C Line 14

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

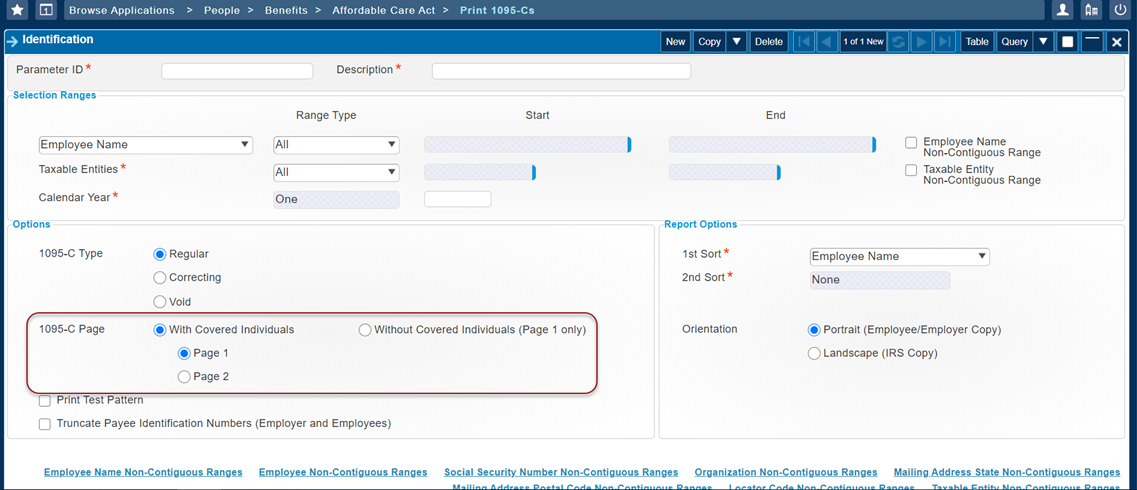

· Sample Excel Import File 1095C xlsx What's New for In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14 "Offer of Coverage" 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S New field, line 17 "Zip code" Import Form FieldsForm 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return · 1095C forms are filed by large employers If they are selffunded, they just fill out all sections of 1095C If they are selffunded, they just fill out all sections of 1095C If they are fully insured, they get a 1095B from the insurer and fill out Sections I and II of 1095C

Aca 1095 C Basic Concepts

Compliance Considerations Covid And 1095 C Reporting Hays Companies

Additions to Reporting for Form 1095C IRS Form 1094C remains unchanged from prior years IRS Form 1095C tax year changes include a new line 17, new offer codes and box for employee's age Form 1095C is now a 2 page form where Boxes 117 are listed on page 1 and the covered individuals are shown on page 2Reporting of ICHRA in Line 14 Codes of Form 1095C for On July 13, , the IRS released a Form 1095C draft, which adds new 1095C codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRA The codes are mentioned here1095C Code Population Guide;

Changes Coming For 1095 C Form Tango Health Tango Health

A C A 1 0 9 5 C C H E A T S H E E T 2 0 2 0 Zonealarm Results

Register for our BernieU course, Intro to Forms 1094C and 1095C, where we cover everything from1095C General Information; · Updated 1/22/ IRS 1095C Reporting FAQ's GENERAL INFORMATION How do I fill out the 1095C form?

Changes Coming For 1095 C Form Tango Health Tango Health

Irs Issues Draft Form 1095 C For Aca Reporting In 21

ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C Each code indicates a different scenario regarding an offer of coverage, Section 4980H Safe Harbor Codes and other relief for ALE Members · Changes Coming for Form 1095C On July 13, , the Internal Revenue Service (IRS) provided a draft that shows changes to the tax forms for Rest assured Tango is reviewing and preparing to comply with the changes The 1094C form that gets transmitted to the IRS and shows the overall compliance for an EIN remains the same · The IRS recently released final Forms 1094C and 1095C and Instructions for Forms 1094C and 1095C (Instructions) Employers offering ICHRAs that intend to furnish Form 1095B instead of 1095C must enter a new Code "G" on Form 1095B, Line 8 to identify the coverage as an ICHRA

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Accurate 1095 C Forms Reporting A Primer Integrity Data

The IRS will not impose a penalty for failure to furnish Form 1095C to any employee enrolled in an ALE member's selfinsured health plan who is not a fulltime employee for any month of if certain conditions are met See Notice 76 and Information reporting penalties Extension of good faith relief for reporting and furnishing · The Form 1095C instructions note that the Code § 4980H(b) affordability threshold for plan years beginning in is 978% (see our Checkpoint article) Both sets of instructions indicate indexed penalty increases for reporting failures from $270 to $280 per return, with calendaryear maximum penalties increasing from $3,339,000 to $3,392,000 · July 15, On July 13, the IRS released the draft iteration of the Form 1095C At first glance, it appears there have been significant changes to the Form However, in reality, most employers will complete the Form 1095C exactly the way they did in previous years

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Form 1095 C Released New Codes New Deadlines

In Part II of Form 1095C, for , the employer is required to input the age of the employee as of January 1st for any employee offered an ICHRA Further, on Line 14, Codes 1L through 1S have been introduced to capture offers of coverage for ICHRAs The addition of these codes induces changes to Part II, Line 15 of the Form 1095C in some casesCODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses this · February 24, Robert Sheen Affordable Care Act 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act

Some Draft Forms For Aca Reporting Released Resecō

Aca Reporting Faq

· Are you aware of what reporting codes are in your annual ACA reporting? · The Form 1095C draft includes codes from 1L to 1S for employers used to determine their ICHRA plan's affordability This final rule came into effect on August 19, 19 and became applicable on July 13, These are the new codes that entered on line 14 of Form 1095C 1LForm 1095C is used to report information about each employee In addition, Forms 1094C and 1095C are used in determining whether an employer owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Microsoft Dynamics Gp Year End Update Affordable Care Act Aca Microsoft Dynamics Gp Community

· According to President Trump's executive order No , new codes are added in the draft IRS Form 1095C for the year The new codes are related to individual coverage HRAs This rule allows businesses to make use of individual coverage HRAs to reimburse workers for the cost of health insurance coverage

Irs Form 1095 C Codes Explained Integrity Data

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Aca Code Cheatsheet

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Federal Updates

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Spreadsheet Import Form 1095 C

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Changes In Irs Form 1095 C For Taxbandits Youtube

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

What Your Clients Need To Know About Form 1095 C Accountingweb

The New 1095 C Codes For Explained

How Do We Report Ichra Coverage On Forms 1094 C And 1095 C

Common Mistakes In Completing Forms 1094 C And 1095 C

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

The Aca S 1095 C Codes For The Tax Year What Employers Need To Know About The Aca 1095 C Codes

What Is Aca Form 1095 C Health Insurance Plans Health Insurance Coverage Affordable Health Insurance

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Form 1095 C Guide For Employees Contact Us

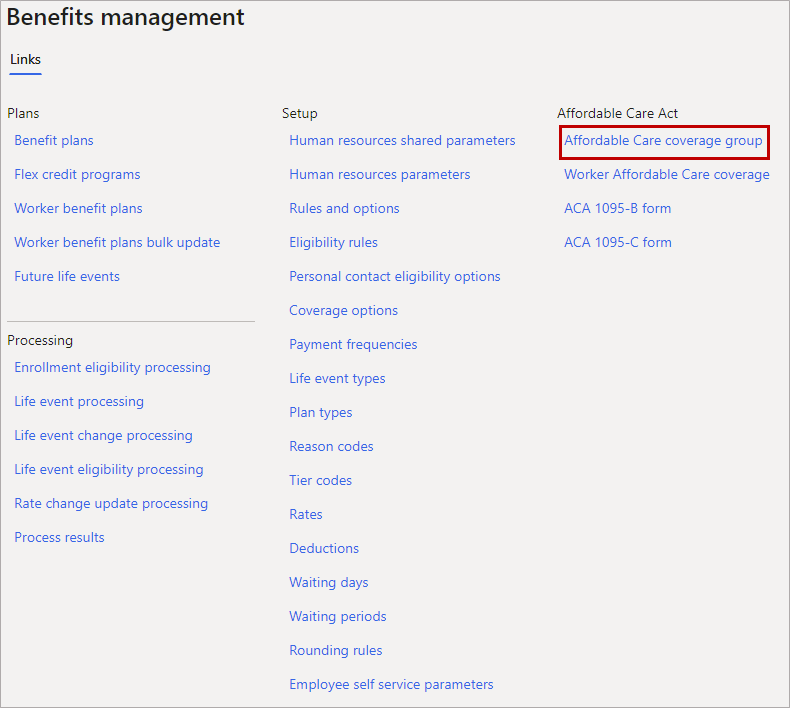

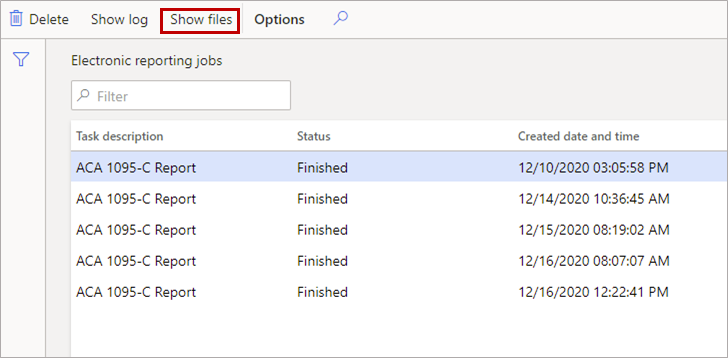

Generate Affordable Care Act Reports In Benefits Management Human Resources Dynamics 365 Microsoft Docs

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

Aca Code Cheatsheet

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Irs Final Aca Compliance Forms Now Available Bernieportal

Irs Distribution Deadline March 2 21 Aca Gps

21 Aca Code Cheatsheet Download Our Free Guide

Aca Code Cheatsheet

Annual Health Care Coverage Statements

21 Aca Reporting Requirements For Employers

Changes In 21 Aca Reporting Health Insurance Coverage Employment How To Plan

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Faqs Mass Gov

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Code Cheatsheet

Aca 1095 C Code Cheatsheet

Irs Form 1095 C Codes Explained Integrity Data

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Microsoft Dynamics Gp Year End Update Affordable Care Act Aca Microsoft Dynamics Gp Community

Instructions For Forms 1095 C Taxbandits Youtube

Aca 1095 C Basic Concepts

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

What S New For Tax Year Aca Reporting Air

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Irs Extends Deadline For Employer Aca Disclosures Buck Buck

1094 C 1095 C Software 599 1095 C Software

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Aca Compliance Hrms Human Capital Management Bizmerlinhr

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Forms 1094 C And 1095 C And Reporting Instructions For Irs Issues Final Aca Forms 1094 C 1095 C And Reporting Instructions

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1094 C 1095 C Software 599 1095 C Software

Generate Affordable Care Act Reports In Benefits Management Human Resources Dynamics 365 Microsoft Docs

1095 C Faqs Office Of The Comptroller

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Code Cheatsheet

What You Need To Know About Aca Annual Reporting Aps Payroll

0 件のコメント:

コメントを投稿